- Source documents filed

- Bank statements reconciled

- Preparation & Lodgement of BAS

- Profit & Loss Quarterly

- Accrual Accounting

- Year End file for Accountant

Welcome to Benchmark Bookkeeping & Payroll

Welcome to Benchmark Bookkeeping & Payroll

About Benchmark Bookkeeping & Payroll

Benchmark is the place for all your accounting and payroll needs, backed by qualified and experienced accountants (Johnson & Mongan Accountants).

Our trusted accountants and bookkeepers specialise in the following:

1) Personal Service – Our friendly staff tailor your advice and services to adhere to what you require.

2) Customer Satisfaction – Business standards in place to ensure deadlines always met and clients always happy.

3) Value for money – Fixed fee pricing available, no hidden charges or surprises and the option to pay monthly with no interest charges.

In summary, providing a high quality, fast and reliable service at a competitive price.

Adam Johnson

B Bus CA / Partner

Jay Mongan

B Bus CA / Partner

Laura Weir

Bookkeeper

Kim Diggs

Bookkeeper

Our Services, Pricing & Packages

Our Services

- Bookkeeping

-

In-house assistance with managing your bookkeeping.

We come to your business, saving you time and money.

- Virtual Bookkeeping

-

Run a paperless office with a virtual bookkeeper.

All of the assistance with all of the freedom.

- Payroll Preparation

-

Don't get lost under the paperwork.

Pay staff, super, organise timesheets and stay compliant with the ATO.

Our Pricing & Packages

- Bookkeeping Starter

-

For clients wanting everything taken care of.

We've got what's needed to keep the Tax Office off your back.

- From $165 per month (GST included)

- Payroll Preparation

-

Perfect for our clients who simply need payroll help

Let our team help out you and your team.

- From $44 per pay period (GST included)

Software Links

Tools & Resources

Latest Accounting News

Restructuring Family Businesses: From Partnership to Limited Company

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships...

Choose the right business structure step-by-step guide

Take out the guesswork out of choosing the right structure for your...

ATO’s holiday home owner tax changes spur taxpayers to be ‘wary and proactive’

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax...

Payday Super part 1: understanding the new law

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to...

A refresher on Medicare levy and Medicare levy surcharge.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public...

Protecting yourself from misinformation

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as...

Super gender gap slowly narrows

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is...

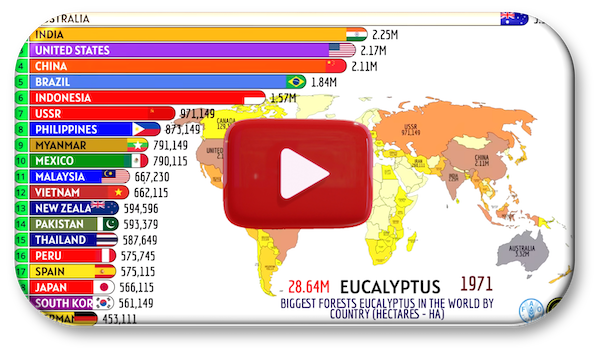

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

One gap when owning and operating a small business is to get a feel for how you are doing compared to your...

Contact Us

Get in Touch

Benchmark Bookkeeping & Payroll welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- 41 Crescent Avenue, Taree NSW 2430